Thriving in a Stabilizing Insurance Market

As 2026 begins, the commercial insurance market is entering a period of cautious stabilization after several years of rising premiums and limited coverage options. While challenges remain in certain areas, improved insurer performance and increased competition are creating more favorable conditions for well-managed businesses.

Understanding where the market stands today and what insurers are prioritizing can help business owners make informed decisions throughout the year.

Signs of Market Stabilization

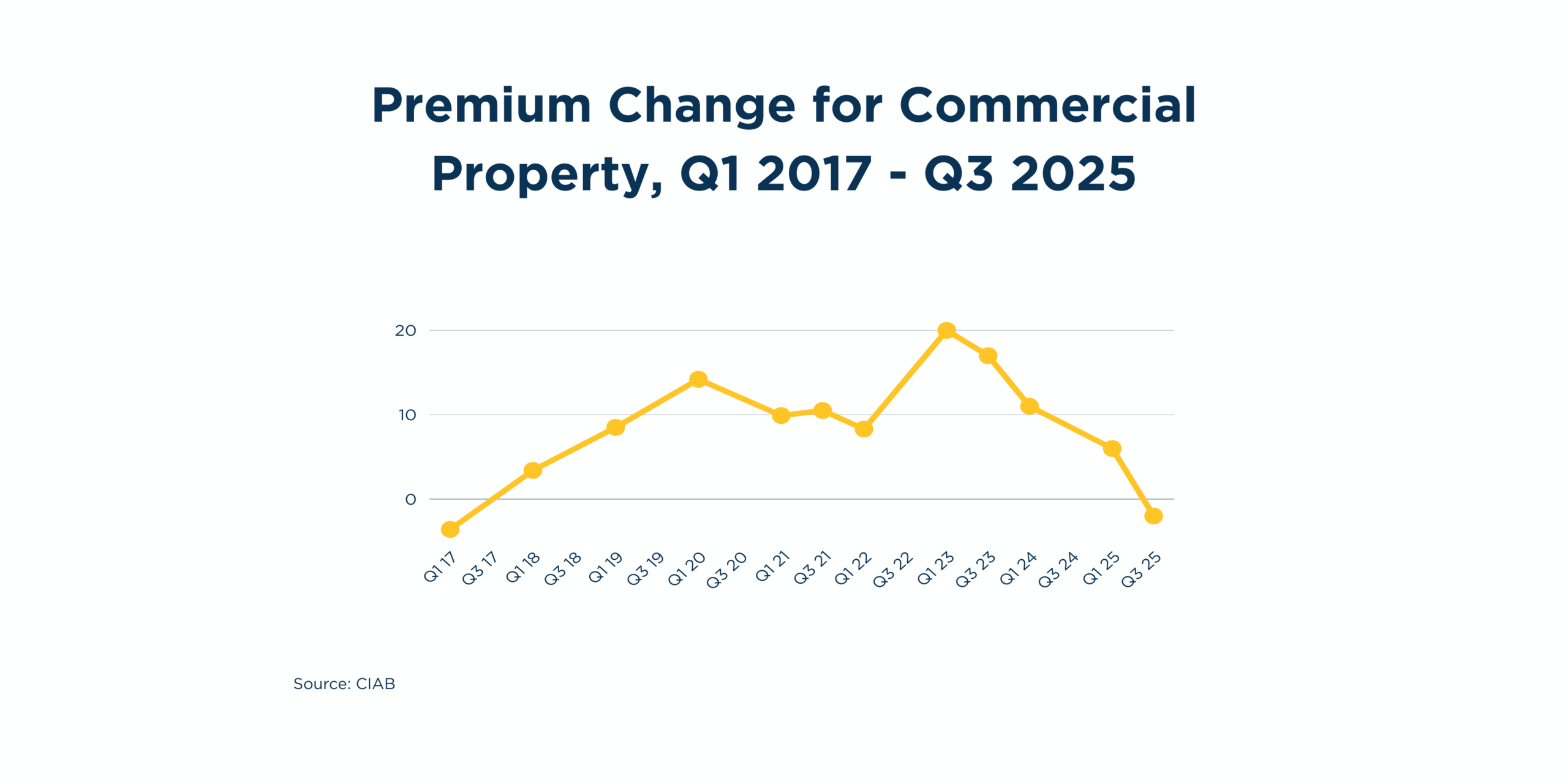

For much of the past decade, businesses navigated a ‘hard market,’ a period when insurance premiums rise, underwriting becomes more restrictive, and coverage options are limited due to higher claim costs and reduced insurer capacity.

Entering 2026, that pressure has begun to ease. Industry data shows overall commercial insurance pricing flattening in late 2025, with some lines experiencing modest declines. Strong reinsurance capacity and improved insurer profitability are allowing carriers to compete more actively for well-managed accounts. This creates better renewal opportunities for businesses with favorable loss histories.

For organizations with favorable loss histories and proactive risk management, renewal conversations in 2026 may feel more balanced than in recent years.

Areas of Continued Market Pressure

Despite positive momentum, several factors continue to influence underwriting decisions and pricing.

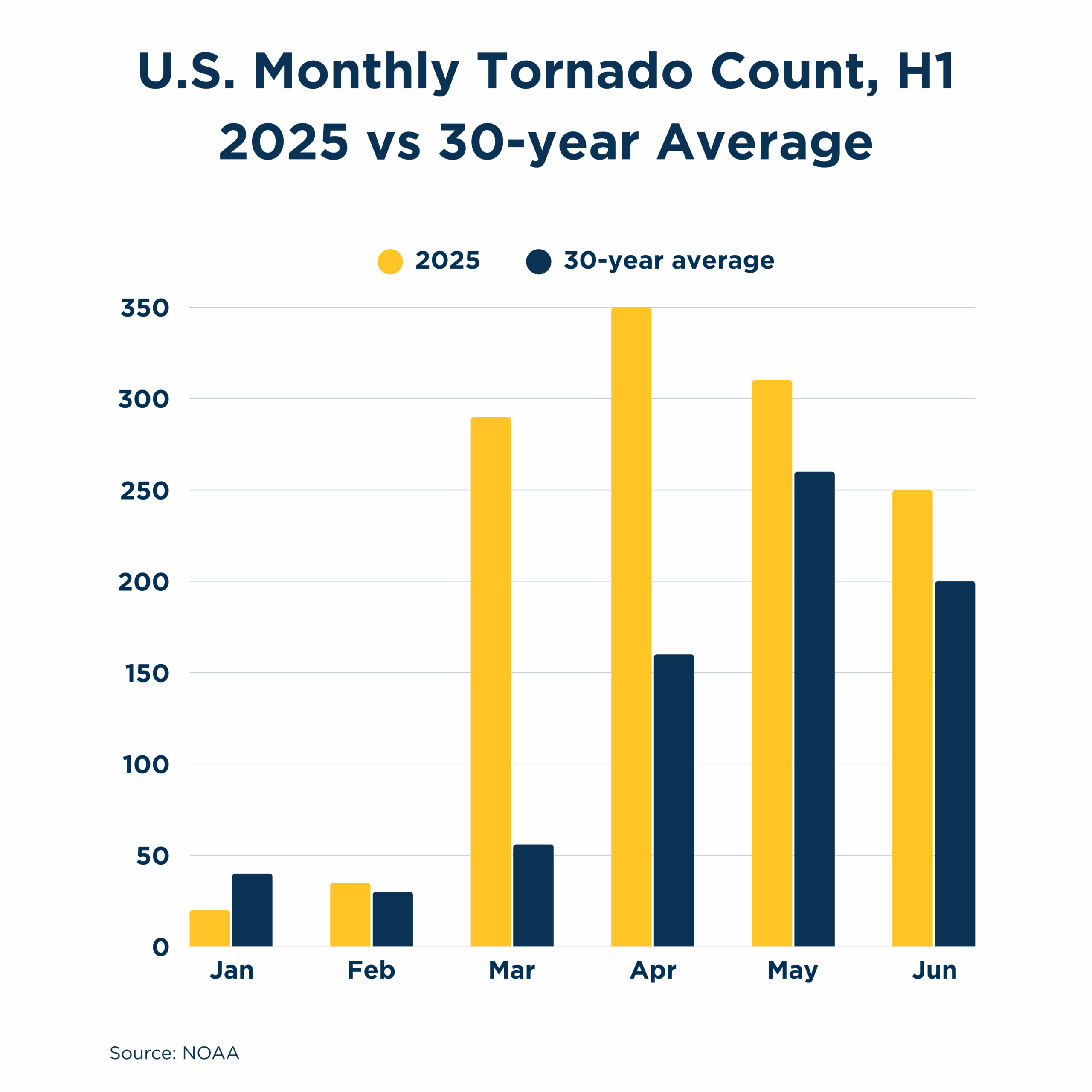

Severe weather losses remain a major concern, particularly for commercial property insurance. A high number of billion-dollar weather events in recent years has led insurers to place greater emphasis on accurate property valuations, deductibles, and risk mitigation efforts, especially in weather-exposed regions

Liability-related coverage also remains under pressure. Litigation trends, often referred to as social inflation, continue to drive higher claim severity. Large jury verdicts are driving increased legal funding, while rising settlement costs continue to impact general liability, commercial auto, and umbrella policies.

While general inflation has moderated, construction, medical, and labor costs remain elevated. These factors continue to affect claim costs and underwriting scrutiny across multiple lines of coverage. Your business can position itself for success as the market continues to stabilize.

Implications for Your Business in 2026

The current market environment rewards preparation and transparency. Insurers are increasingly differentiating between risks rather than applying broad pricing increases.

Businesses that demonstrate stable operations, strong safety practices, accurate data, and consistent loss control are better positioned to access competitive pricing and coverage terms. Those with unmanaged exposures or outdated information may continue to face challenges.

Even in a stabilizing market, early planning pays off. Working with a knowledgeable advisor such as Shepherd Insurance can help your business manage risk, control costs, and adapt to ongoing changes.

Staying informed and engaged throughout the year is one of the most effective ways to protect your business and make confident coverage decisions.

How Shepherd Supports Commercial Clients

Navigating today’s insurance landscape requires more than a transactional approach. At Shepherd Insurance, our Commercial Insurance team works closely with businesses to understand their operations, identify emerging risks, and position accounts effectively within the market.

Through early planning, carrier advocacy, and tailored risk strategies, we help clients make informed coverage decisions that align with their goals and long-term plans. Whether you’re reviewing existing coverage or exploring new options, Shepherd Insurance can help you navigate the market with clarity and confidence. Contact our commercial insurance team today to start planning for 2026.